XYL Stock Recent News

XYL LATEST HEADLINES

Xylem (XYL) came out with quarterly earnings of $1.26 per share, beating the Zacks Consensus Estimate of $1.14 per share. This compares to earnings of $1.09 per share a year ago.

WASHINGTON--(BUSINESS WIRE)-- #LetsSolveWater--Xylem Inc. (NYSE: XYL), a leading global water solutions company dedicated to solving the world's most challenging water issues, today reported second-quarter 2025 results. The Company delivered total revenue of $2.3 billion, on strong execution and demand. Second-quarter earnings per share were up 16 percent on a reported and adjusted basis. “Our team delivered another strong quarter, exceeding expectations with robust organic revenue growth across all segments, a.

Beyond analysts' top-and-bottom-line estimates for Xylem (XYL), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended June 2025.

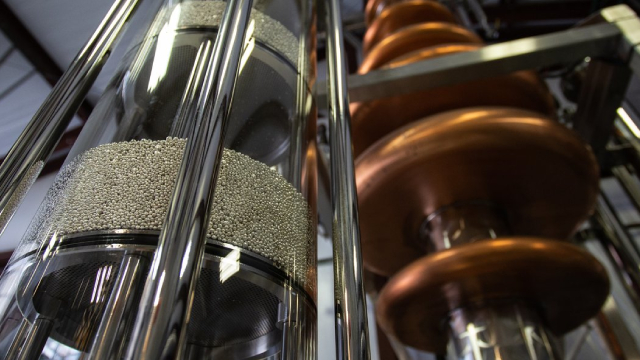

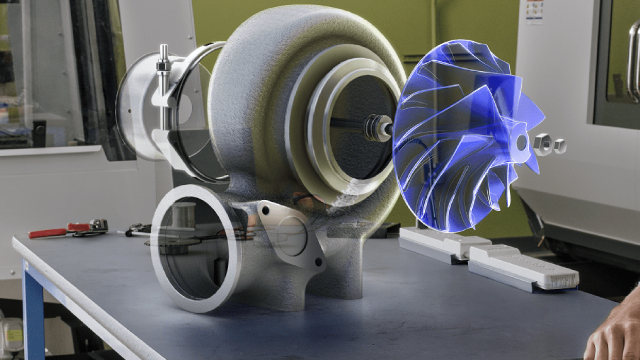

I rate Xylem a buy, driven by secular water scarcity, aging infrastructure, and PFAS treatment themes that ensure durable, non-discretionary demand. XYL's 80/20 transformation is already delivering tangible margin gains, with further upside from the Evoqua integration and PFAS funding pipeline. Despite near-term softness in some segments and tariff headwinds, XYL's long-term growth is underpinned by resilient end markets and internal self-help levers.

AEM, DIS, ADBE and XYL show strong sales growth and solid cash flow, offering resilience in a volatile market.

WASHINGTON--(BUSINESS WIRE)--Xylem Inc. (NYSE: XYL), a leading global water solutions company that empowers customers and communities to build a more water-secure world, will release its second quarter 2025 results at 6:55 a.m. (ET) on July 31, 2025. At 9:00 a.m. (ET), Xylem's senior management team will host a conference call with investors. The call can be accessed by calling +1 (866) 777-2509 (US) or +1 (412) 317-5413 (INTL) or by visiting Investors Events | Xylem US. A replay of the briefin.

XYL rides on strength across operating segments and acquisitions, but high debt and costs remain headwinds.

Xylem (XYL) reported earnings 30 days ago. What's next for the stock?

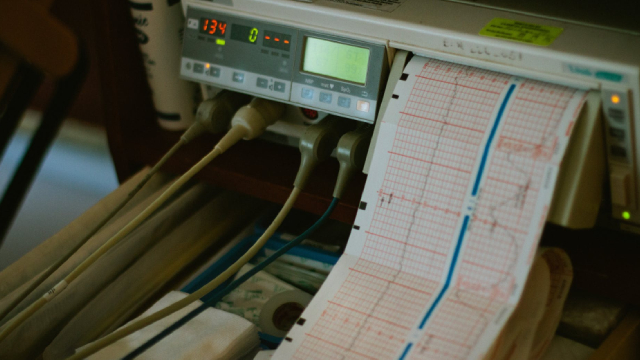

WASHINGTON--(BUSINESS WIRE)-- #LetsSolveWater--Manchester City Football Club is using data and analytics for more than performance on the pitch. A champion of water sustainability, the Club is taking its commitment to the next level – introducing digital solutions from its official water technology partner, Xylem (NYSE: XYL), to help capture and reuse rainwater more efficiently. At City Football Academy, Xylem Vue – a digital water platform – uses connected sensors and smart meters to deliver live insights into.

WASHINGTON--(BUSINESS WIRE)-- #LetsSolveWater--Utilities and businesses have reused 18.1 billion cubic meters of water since 2019, enabled by solutions from global water technology leader Xylem.