XYL Stock Recent News

XYL LATEST HEADLINES

WASHINGTON--(BUSINESS WIRE)-- #LetsSolveWater--Xylem Inc. (NYSE: XYL), a leading global water solutions company that empowers customers and communities to build a more water-secure world, announced today that it will participate in the following upcoming conferences: Oppenheimer Industrials Conference, May 5, Virtual – Management and Investor Relations will present and participate in investor meetings. Stifel Industrials Conference, June 4, Boston – Management and Investor Relations will present and participate.

The S&P 500 index has crashed hard this year, erasing some of the gains made last year. The SPX crashed by 5.8% on Friday, meaning that it has crashed by over 17.5% from its highest level this year.

Xylem Inc. shows strong financial performance with $8.6 billion revenue, 11% dividend increase, and expanding margins, driven by resilient utility spending and stricter EPA rules. The company's robust backlog, innovative digital tools, and focus on climate-resilient water solutions position it for sustained growth despite short-term restructuring costs. XYL's solid balance sheet, and strategic acquisitions like Evoqua support its premium valuation and long-term growth potential in the water tech sector.

Over the past few months, threats of higher tariffs, sticky inflation, and elevated interest rates weighed down many macro-sensitive sectors. Those headwinds also drove many investors toward more conservative energy and utility stocks.

WASHINGTON--(BUSINESS WIRE)-- #LetsSolveWater--Xylem Inc. (NYSE: XYL), a leading global water solutions company that empowers customers and communities to build a more water-secure world, will release its first quarter 2025 results at 6:55 a.m. (ET) on April 29, 2025. At 9:00 a.m. (ET), Xylem's senior management team will host a conference call with investors. The call can be accessed by calling +1 (866) 777-2509 (US) or +1 (412) 317-5413 (INTL) or by visiting Investors Events | Xylem US. A replay of the briefin.

XYL is set to benefit from solid momentum across its M&CS, Water Infrastructure and Water Solutions and Services segments. However, rising costs remain a concern.

This week's dividend increases feature three Dividend Kings: Archer-Daniels-Midland, Consolidated Edison, and Black Hills Corporation, with streaks of 50, 51, and 55 years, respectively. Consistently rising dividends indicate strong cash flow and financial stability, making such companies attractive long-term investments that often outperform benchmarks. My strategy focuses on stocks with consistent dividend growth and market outperformance, using data from U.S. Dividend Champions and NASDAQ.

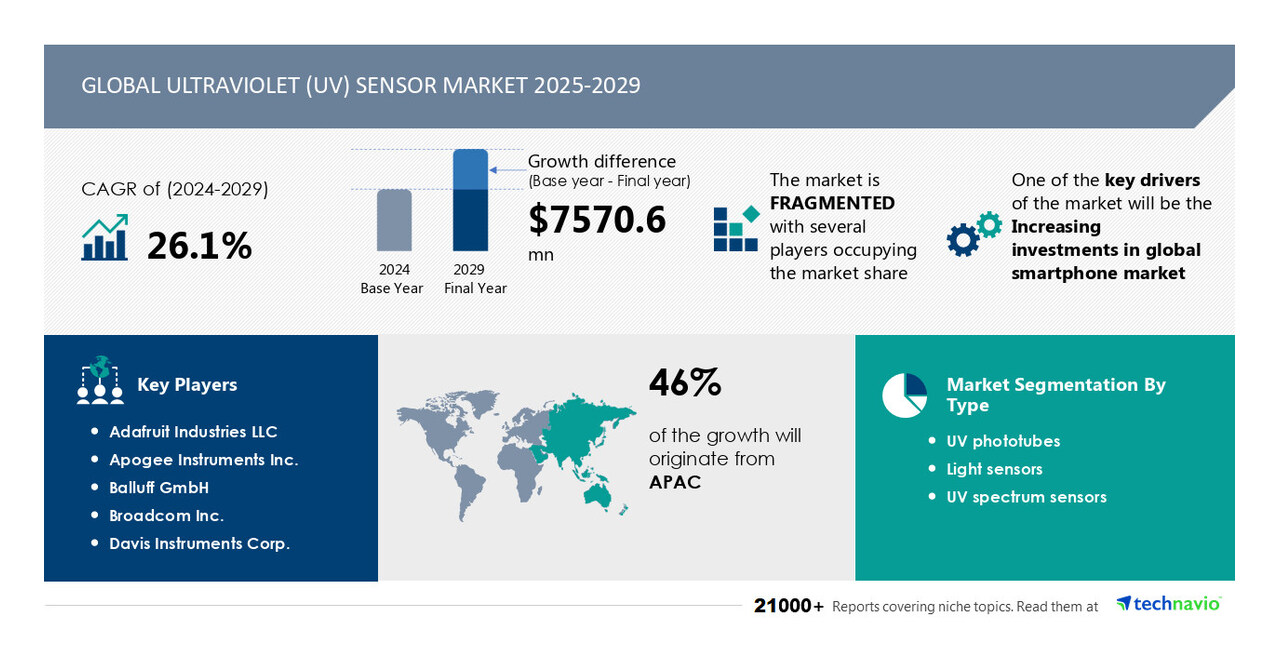

NEW YORK, Feb. 13, 2025 /PRNewswire/ -- Report with the AI impact on market trends - The ultraviolet (UV) sensor market and it is set to grow by USD 7.57 billion from 2025 to 2029. However, the growth momentum will progressing at a CAGR of almost 26.1% during the forecast period, according to Technavio. The ultraviolet (uv) sensor market is fragmented, and the vendors are seeking strong partnerships with automotive, industrial, and commercial companies to compete in the market. Adafruit Industries LLC, Apogee Instruments Inc., Balluff GmbH, Broadcom Inc., Davis Instruments Corp., GaNo Optoelectronics Inc., Genicom Co. Ltd., LAPIS Semiconductor Co. Ltd., Panasonic Holdings Corp., sglux GmbH, Silicon Laboratories Inc., Skye Instruments Ltd., Solar Light Co. Inc., STMicroelectronics NV, TRI TRONICS, UV-Technik Speziallampen GmbH, Vernier Software and Technology LLC, Vishay Intertechnology Inc., Xylem Inc., and ZED Ziegler Electronic Devices GmbH are some of the major market participants -

SWORDS, Ireland--(BUSINESS WIRE)--Trane Technologies (NYSE: TT), a global climate innovator, announced the appointment of Matthew Pine, president and CEO, Xylem Inc. (NYSE: XYL), to its Board of Directors, effective April 1, 2025. “Matthew will be a strong addition to our Board of Directors given his global leadership experience and proven track record of transformation in large industrial companies,” said Dave Regnery, chair and CEO of Trane Technologies. “His passion for sustainability, innov.

Xylem Inc. (NYSE:XYL ) Q4 2024 Earnings Conference Call February 4, 2024 9:00 AM ET Company Participants Keith Buettner - Vice President, Investor Relations & Financial Planning & Analysis Matthew Pine - Chief Executive Officer William Grogan - Chief Financial Officer Conference Call Participants Deane Dray - RBC Capital Markets Michael Halloran - Baird Nathan Jones - Stifel Andrew Kaplowitz - Citigroup Scott Davis - Melius Research Brian Lee - Goldman Sachs Andrew Buscaglia - BNP Operator Welcome to Xylem's Fourth Quarter and Full Year 2024 Results Conference Call. All participants will be in listen-only mode.