AIT Stock Recent News

AIT LATEST HEADLINES

Evaluate Applied Industrial Technologies' (AIT) reliance on international revenue to better understand the company's financial stability, growth prospects and potential stock price performance.

Applied Industrial Technologies, Inc. AIT reported better-than-expected earnings for the fourth quarter on Thursday.

The headline numbers for Applied Industrial Technologies (AIT) give insight into how the company performed in the quarter ended June 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

AIT posts Q4 EPS of $2.80, beating estimates, with revenues up 5.5% as acquisitions and Engineered Solutions growth drive gains.

Applied Industrial Technologies, Inc. (NYSE:AIT ) Q4 2025 Earnings Conference Call August 14, 2025 10:00 AM ET Company Participants David K. Wells - VP, CFO, & Treasurer Neil A.

Applied Industrial Technologies (AIT) came out with quarterly earnings of $2.8 per share, beating the Zacks Consensus Estimate of $2.6 per share. This compares to earnings of $2.64 per share a year ago.

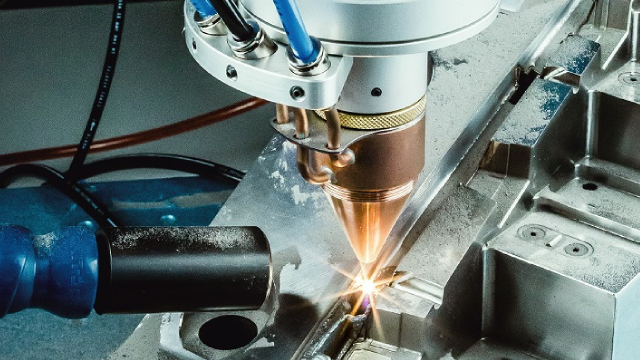

CLEVELAND--(BUSINESS WIRE)--Applied Industrial Technologies (NYSE: AIT), a leading value-added distributor and technical solutions provider of industrial motion, fluid power, flow control, automation technologies, and related maintenance supplies, today reported results for its fiscal 2025 fourth quarter and full year ended June 30, 2025. Net sales for the quarter of $1.2 billion increased 5.5% over the prior year. The change includes a 6.5% increase from acquisitions, partially offset by a neg.

Applied Industrial's Q4 results are likely to show revenue gains from automation and acquisitions, offset by weakness in Service Center operations.

Get a deeper insight into the potential performance of Applied Industrial Technologies (AIT) for the quarter ended June 2025 by going beyond Wall Street's top-and-bottom-line estimates and examining the estimates for some of its key metrics.

Applied Industrial Technologies (AIT) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.