EMR Stock Recent News

EMR LATEST HEADLINES

In the closing of the recent trading day, Emerson Electric (EMR) stood at $144.39, denoting a +2.92% move from the preceding trading day.

ST. LOUIS , July 16, 2025 /PRNewswire/ -- Emerson (NYSE: EMR) will report its third quarter results prior to market open on Wednesday, August 6, 2025. Emerson senior management will discuss the results during an investor conference call that same day, beginning at 7:30 a.m.

The Investment Committee reveals the stocks they're watching closely.

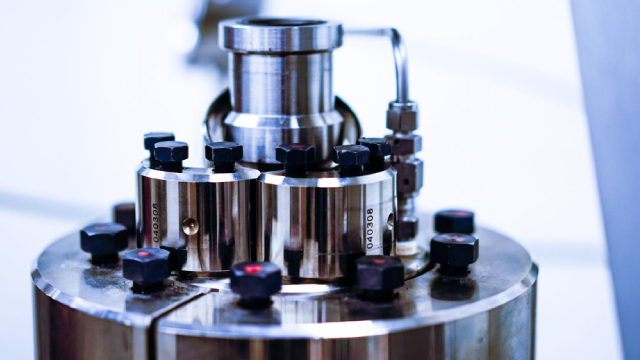

Ovation Virtual Advisor provides real-time intelligence to optimize operations and support resilient critical infrastructures PITTSBURGH , July 15, 2025 /PRNewswire/ -- Emerson (NYSE: EMR), an industrial technology leader delivering advanced automation solutions, has announced the launch of the Ovation™ AI-enabled Virtual Advisor – the first generative artificial intelligence (GenAI) advisor integrated into an automation system specifically designed for the power and water industries. The addition of an AI-enabled virtual advisor as part of Emerson's Ovation 4.0 Automation Platform delivers real-time insights to increase efficiency, detect anomalies, forecast maintenance issues and empower strategic decision-making.

Investors love dividend stocks because they provide dependable passive income streams and an excellent opportunity for solid total return.

Emerson Electric (EMR) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Does Emerson Electric (EMR) have what it takes to be a top stock pick for momentum investors? Let's find out.

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Investing in the stock market over a long-term time horizon can be an excellent way to compound your savings. However, the path toward unlocking significant gains can be marked by numerous ups and downs.

Finding stocks expected to beat quarterly earnings estimates becomes an easier task with our Zacks Earnings ESP.