EMR Stock Recent News

EMR LATEST HEADLINES

Emerson Electric (EMR) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Emerson Electric (EMR) concluded the recent trading session at $137.79, signifying a +1.68% move from its prior day's close.

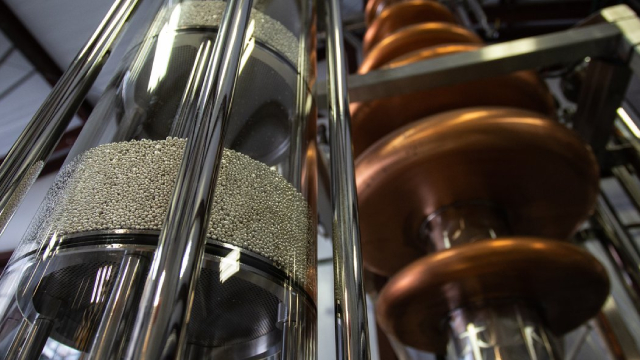

Emerson Electric's strategic M&A has shifted its portfolio from hardware to higher-growth, higher-margin software, now comprising 31% of revenue. Our analysis shows Emerson's software segment enjoys both organic and inorganic growth, with competitive advantages in specialized industries like oil & gas, semiconductors, and life sciences. Strong integration between Emerson's hardware and software drives cross-selling, recurring revenue, and customer stickiness, leveraging its large installed base.

Report highlights continued investments in employees, customers, suppliers and communities as Emerson works to make the world healthier, safer, smarter and more sustainable ST. LOUIS , July 1, 2025 /PRNewswire/ -- Emerson (NYSE: EMR), an industrial technology leader delivering advanced automation solutions, today released its 2024 Sustainability Report, which reflects progress on the Company's ongoing efforts to advance innovation, enhance operational excellence and create lasting value for stakeholders.

Emerson Electric is a leader in industrial automation, benefiting from automation, digitalization, and sustainability trends, making it a compelling long-term investment. The company's expanding software and services portfolio, strong recurring revenues, and robust free cash flow underpin its market leadership and financial resilience. Risks include project-based revenue volatility, oil and gas exposure, and execution risks from major acquisitions, but strong backlogs and order momentum provide visibility.

Emerson Electric (EMR) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Dividend stocks not only offer a regular stream of passive income but are also proven wealth-builders, especially if you invest in top-notch dividend growth stocks and reinvest the dividends. Doing so could even earn you monstrous returns over time due to the power of compounding.

Emerson Electric (EMR) concluded the recent trading session at $132.73, signifying a +2.54% move from its prior day's close.

In the closing of the recent trading day, Emerson Electric (EMR) stood at $130.73, denoting a +1.02% move from the preceding trading day.

Dividend Kings have underperformed the S&P 500 year-to-date, but 26 are outperforming SPY in 2025, with 32 posting positive returns. Dividend growth remains healthy, with four recent increases and a collective 2025 growth rate of 5.19%, despite some downward earnings revisions. Seventeen Dividend Kings appear undervalued and offer long-term annualized expected returns of at least 10%, based on Dividend Yield Theory analysis.