EMR Stock Recent News

EMR LATEST HEADLINES

Emerson Electric (EMR) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

ST. LOUIS , June 3, 2025 /PRNewswire/ -- Emerson (NYSE: EMR) today announced Chief Operating Officer, Ram Krishnan will present at Wells Fargo's 2025 Industrials & Materials Conference on Tuesday, June 10 th in Chicago, Illinois. The presentation will begin at 3:00 p.m.

Investors love dividend stocks because they provide dependable passive income streams and an excellent opportunity for solid total return.

Despite having made $40 billion worth of acquisitions over the last four years, global industrial automation and technology giant Emerson (NYSE: EMR) may not be quite done yet, according to the company's chief operating officer Ram Krishnan.

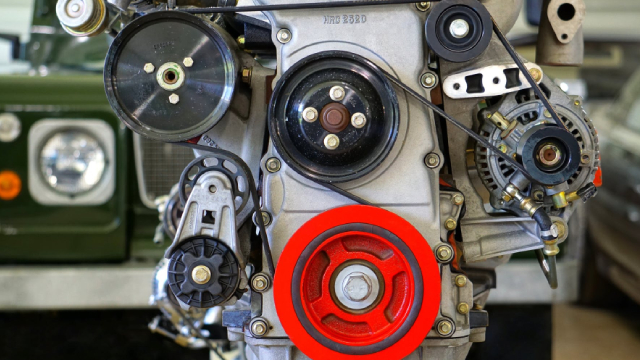

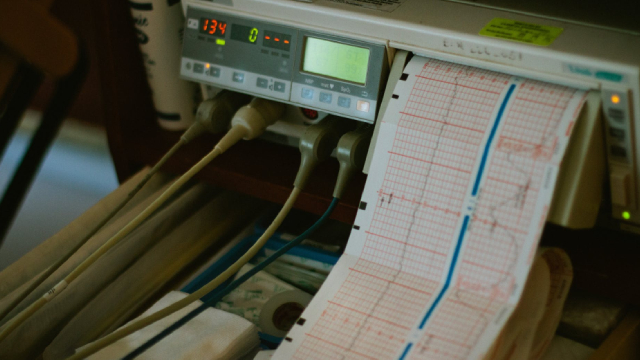

Fit-for-purpose industrial AI offerings increase accessibility and confidence to help manufacturers drive more efficiency and performance from automation investments SAN ANTONIO, May 22, 2025 /PRNewswire/ -- Emerson (NYSE: EMR), an industrial technology leader delivering advanced automation solutions, is empowering manufacturers across every industry to drive toward optimized autonomous operations with the most advanced industrial artificial intelligence (AI) and data solutions for online, mission-critical applications. Emerson's extensive AI portfolio – supported by its recent acquisition of the Aspen Technology business and built on decades of domain expertise – will help organizations implement AI solutions that deliver consistent, sustainable value.

I analyze 50 Bloomberg 'Companies to Watch' for 2025, focusing on the 35 that pay dividends and applying the yield-based dogcatcher strategy. 15 of these dividend payers are 'safer' stocks, with free cash flow yields exceeding dividend yields—five are IDEAL candidates for watch-to-buy. Top ten dividend dogs offer estimated average net gains of 21.33% for the coming year, but investors should beware of cash-poor stocks with negative free cash flow margins.

Emerson Electric (EMR) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Emerson Electric is well-positioned for growth in major megatrend spending cycles, including aerospace & defense, energy & LNG, and industrial automation. Management remains focused on mitigating tariff risks through surcharges and price increases, as well as adjusting its manufacturing footprint and supply chain to minimize impacts to margins. Management is focused on reducing debt, targeting a 2x leverage ratio, and allocating free cash flow to shareholder returns and strategic acquisitions.

EMR's second-quarter fiscal 2025 revenues inch up 1% year over year, driven by strength in its Software and Control segment.

Although the revenue and EPS for Emerson Electric (EMR) give a sense of how its business performed in the quarter ended March 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.