NVDA Stock Recent News

NVDA LATEST HEADLINES

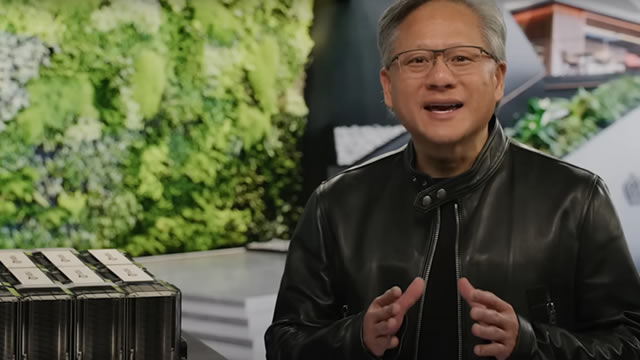

Every few decades, the technology world is reshaped by a generational visionary who somehow seems to see the future before it actually unfolds. Right now, the most important technologist might just be Jensen Huang, the CEO of Nvidia (NVDA -2.26%).

Nvidia's (NASDAQ: NVDA) stock price has taken a hit, retreating from its recent high above $180. However, artificial intelligence (AI) tools are projecting that the equity will likely reclaim this level by the end of August.

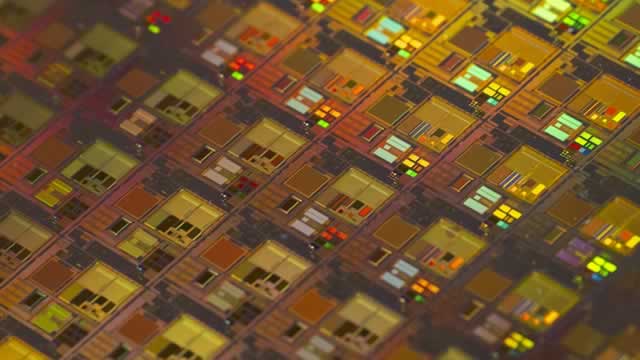

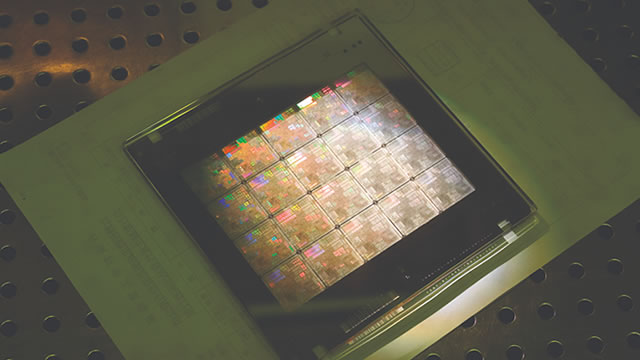

Nvidia (NVDA -2.26%) recently became the world's first $4 trillion tech titan -- but the second quarter could be the spark for its next mega move. With quantum computing breakthroughs, artificial intelligence (AI) networking dominance, and a stealth China rebound on the horizon, this earnings report might deliver more than Wall Street expects.

Semiconductor designer Nvidia (NVDA -2.26%) has split its stock six times so far, including a splashy 10-for-1 split in June 2024. The shares are climbing to new highs again with a market cap of $4.34 trillion.

The last year has been a wild ride for many investors, with a huge swing down in the market in the spring before rocketing back up to today's highs. For investors who want to keep that momentum going, here are four growth-focused companies that would be a smart place to park $1,000.

Tech stocks aren't usually the first place to look for value, but that doesn't mean you can't find undervalued ones. Currently, several top-tier tech names are trading with forward price/earnings-to-growth (PEG) ratios under 1 -- something that typically indicates a stock is undervalued relative to its growth.

Bread is great. Meat -- or the vegetarian filling of your choice -- is great, too.

Earlier in July, U.S. Secretary of Commerce Howard Lutnick gave chipmakers like Nvidia the green light to start selling certain AI chips in China again, but his department is said to be holding things up.

Earlier in July, U.S. Secretary of Commerce Howard Lutnick gave chipmakers like Nvidia the green light to start selling certain AI chips in China again, but his department is said to be holding things up.

Ted Thatcher discusses the overall market picture as investors dissect the latest labor market data and what it means for the Fed's rate cut outlook. He talks about the A.I.