NVDA Stock Recent News

NVDA LATEST HEADLINES

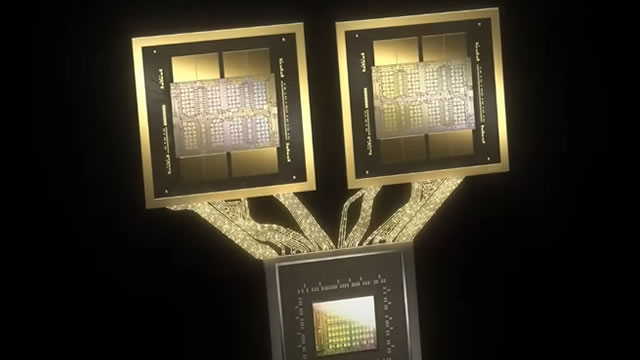

OpenAI said it is launching a Stargate AI data center in Norway which will be designed and built by Nscale and Aker. The site aims to deliver 100,000 NVIDIA graphics processing units (GPU) by the end of 2026.

According to China's Cyberspace Administration, Nvidia met with Beijing officials on Thursday regarding potential national security risks posed by its H20 graphics processing units. Washington this month allowed Nvidia to resume sales of its H20 AI chips to China, reversing an effective ban imposed in April.

China's cyberspace regulator summoned Nvidia on Thursday over security risks related to its H20 chips, it said in a statement.

When ChatGPT was released to the broader public on Nov. 30, 2022, Nvidia had a market capitalization of just $345 billion. As of the closing bell on July 25, 2025, its market cap had eclipsed $4.2 trillion, making it the most valuable company in the world -- by a pretty wide margin, too.

Nvidia (NVDA 2.13%) is the world's largest company by market cap, and its stock has been a stellar performer over the past few years.

Nvidia's $4 trillion milestone might just be the beginning. With artificial intelligence (AI) chip exports to China resuming and the Blackwell platform set to dominate, Nvidia could be the surprise growth story of the year.

Microsoft shares jumped in extended trading on Wednesday, pushing the company's market cap past $4 trillion. The software giant reported better-than-expected quarterly results and said Azure's annual revenue topped $75 billion.

SANTA CLARA, Calif., July 30, 2025 (GLOBE NEWSWIRE) -- NVIDIA will host a conference call on Wednesday, August 27, at 2 p.m.

NVDA's strong profits, AI-driven demand, and hybrid quantum ambitions put it ahead of IONQ's high-cost growth strategy.

Close Shares of Marvell Technology (MRVL) soared on Wednesday after Morgan Stanley raised its price target on the chipmaker’s stock, citing the “exceptional” strength of AI demand. Morgan Stanley analyst Joseph Moore on Wednesday raised his Marvell price target by about 10% to $80 while maintaining an “equal weight” rating. “Marvell is firmly in the AI winners camp, and sentiment has swung aggressively negative compared to a few months ago,” Moore wrote. “We are more excited for their opportunity in optical, which brings higher margin and durability vs. their ASIC opportunity, which has disappointed.” (ASIC refers to application-specific integrated circuit, a class of customizable chip that combines several circuits to perform tasks that would otherwise require multiple interconnected chips.) Marvell shares were up more than 9% in recent trading, making it the best-performing stock in the Nasdaq 100. Despite Wednesday's gain, Marvell shares are down about 23% since th