NVDA Stock Recent News

NVDA LATEST HEADLINES

At this point, it seems highly likely that artificial intelligence (AI) is on track to be the most impactful new technology since the internet. While the progression of the tech trend will certainly bring some twists and turns for investors, there's a good chance that the AI revolution is still in relatively early innings.

With the year half over, it's clear that one theme has dominated the market: artificial intelligence. AI remains the prevailing theme because AI hyperscalers continue to invest substantial amounts of money in it.

After declines earlier in the year, many artificial intelligence (AI) stocks have rebounded and even skyrocketed amid optimism that U.S. trade decisions won't weigh heavily on growth. Which of these players might continue to soar after reaching record highs recently?

Two Chinese graphics chip startups, Moore Threads and MetaX, are aiming to raise a combined $1.65 billion via listings on Shanghai's tech-focused STAR Market, according to a Reuters report. The move comes as US export controls on advanced semiconductors spur efforts to strengthen China's domestic capabilities in AI chipmaking.

As AI accelerates, the race for dominance in chips, AI, and code could reshape global power dynamics, George Chen, Managing Director and Co-Chair of the Digital Practice at The Asia Group, told CNBC at East Tech West 2025. “Technology is also a people business,” he said, pointing to the growing trend of Chinese and Indian engineers leaving Silicon Valley and returning to their home countries.

Alphabet's (GOOG -0.43%) (GOOGL -1.19%) Waymo unit is widely considered the front-runner in the driverless vehicle space, while Tesla (TSLA -1.71%) generates the most publicity in this realm, with its CEO touting that it will be the first to "solve autonomy."

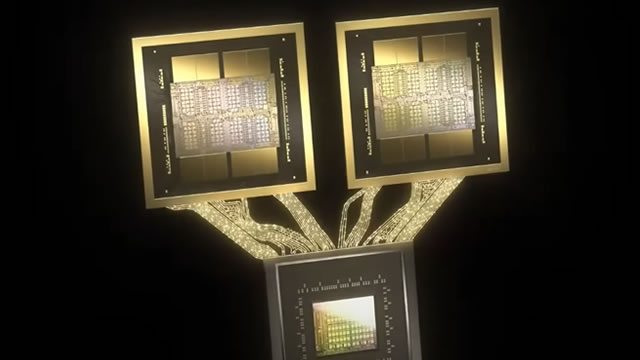

Nvidia Corporation's fundamentals remain robust with respectable growth in revenue and EPS while operating cash flows saw a major increase. The Data Center segment leads performance, and Sovereign AI demand could drive future growth not yet reflected in current guidance or valuation. Nvidia's P/S ratio is below its three-year average, suggesting undervaluation, especially given the potential for reaccelerated growth from global AI spending.

After starting calendar Q2 with a huge "Liberation Day" dip, the Nasdaq and S&P 500 once again close at new all-time highs.

Nvidia executives have offloaded over $1 billion in shares during the company's AI-driven stock surge, with CEO Jensen Huang's potential sales potentially worth $900 million this year.

AI stocks have been on a ferocious rally in June. NVIDIA (Nasdaq: NVDA) is up 13% in the past month and currently sits at an all-time high, trading for $157.75 per share. In the segment below, 24/7 Wall St. Analyst Eric Bleeker discusses the big news that’s been driving AI stocks north. Recent news from Oracle (Nasdaq: ORCL) and OpenAI partnering with Google are all bullish and point toward continuing rabid demand in the AI space. Key Points OpenAI’s growing compute needs have led it to form new partnerships beyond Microsoft (NASDAQ: MSFT), including with Google (NASDAQ: GOOGL), signaling unexpectedly strong infrastructure demand. Oracle (NYSE: ORCL) reported a surge in AI-related revenues, with infrastructure growth forecasted to accelerate from 50% to 70% and backlog (RPO) expected to double, reinforcing signs of industry-wide AI momentum. Despite earlier fears of a pullback in AI spending post-Deep Seek, high model usage retention and ongoing training needs suggest accel