PINS Stock Recent News

PINS LATEST HEADLINES

If you don't want to chase all-time highs and buy stocks at extremely high valuations, the good news is that there are many decently priced options. And below, I'm going to focus on what I think are some of the best deals available.

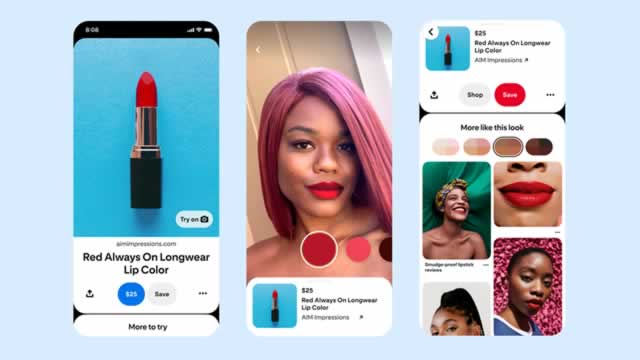

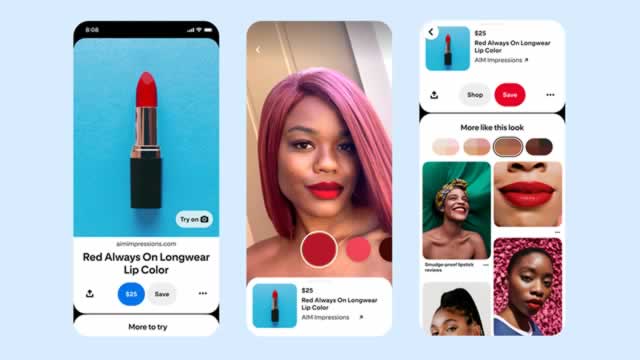

Despite the negative reaction of the stock, Pinterest delivered solid results in the second quarter. AI investments and ad tech improvements are driving engagement and ad performance, with international expansion and partnerships fueling future growth. Margins and free cash flow are also improving, although gains in recent quarters have been modest.

Pinterest delivered strong Q2 results, with revenue and EBITDA exceeding expectations, driven by robust MAU and ARPU growth, especially in international markets. Management's focus on AI-driven engagement, improved ad tools, and international monetization is fueling market share gains and higher advertiser performance. Despite accelerating declines in ad pricing and downward revisions to earnings estimates, revenue growth outlook remains solid through FY27.

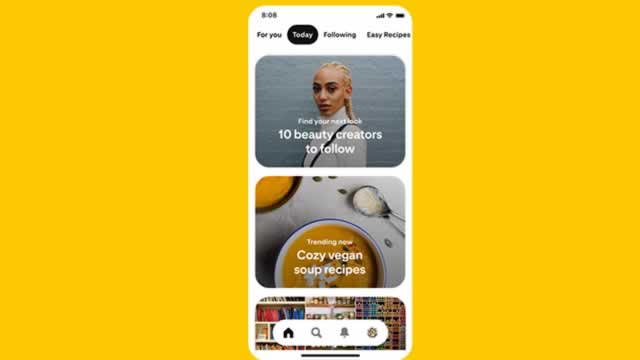

Pinterest offers "growth at a reasonable price" as small/mid-cap stocks face backlash and S&P 500 valuations peak. Despite a 10% post-earnings dip, Pinterest's stabilizing user trends and double-digit EBITDA growth present a compelling buying opportunity. Key catalysts include strong overseas monetization, Gen Z popularity, and disciplined cost controls driving robust profit expansion.

Pinterest continues to deliver solid user and revenue growth, supported by strong profitability and an aggressive share repurchase program. Despite underperforming Meta, Pinterest's valuation remains attractive, trading at a significant discount while maintaining a net cash balance sheet. Management's focus on partnerships and a younger demographic, plus margin expansion, are key drivers for potential multiple expansion over time.

Pinterest (PINS) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Share prices of Pinterest (PINS 2.80%) sank last week after the visual pin-board operator's second-quarter earnings missed expectations. However, revenue and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) came in above expectations, and guidance was strong.

Pinterest's solid Q2 revenues and AI-driven ad tools fuel growth, but rising costs and tough competition weigh on margins.

Cathie Wood is one of the country's best known growth investors, but sometimes, she acts like an umbrella-toting value investor. The Ark Invest co-founder, CEO, and chief investment officer is often adding to some of her sinking positions on any given market day, and that's exactly what she did on the final trading day of last week.

Pinterest (NYSE:PINS) has recently experienced a 10% decline after its quarterly earnings fell short of expectations. Nevertheless, despite this downturn, we consider the stock to be a worthwhile investment at its current price of approximately $35.