PINS Stock Recent News

PINS LATEST HEADLINES

U.S. stock futures were higher this morning, with the Dow futures gaining around 100 points on Friday.

A flurry of company earnings led to big stock moves early Friday.

Pinterest Inc (NYSE:PINS) shares tumbled more than 11% after hours on Thursday, erasing around $3 billion from its market value, after the company missed second-quarter profit forecasts despite strong revenue and user growth. Adjusted earnings came in at 33 cents per share, below analysts' expectations of 35 cents.

Pinterest, Inc. (NYSE:PINS ) Q2 2025 Earnings Conference Call August 7, 2025 4:30 PM ET Company Participants Andrew Somberg - VP of Investor Relations & Treasury Julia Brau Donnelly - Chief Financial Officer William J. Ready - CEO & Director Conference Call Participants Brian Thomas Nowak - Morgan Stanley, Research Division Colin Alan Sebastian - Robert W.

While the top- and bottom-line numbers for Pinterest (PINS) give a sense of how the business performed in the quarter ended June 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Pinterest (PINS) came out with quarterly earnings of $0.33 per share, missing the Zacks Consensus Estimate of $0.34 per share. This compares to earnings of $0.29 per share a year ago.

Pinterest stock fell following Q2 results that failed to blow away targets in the same way Meta's and Reddit's results did.

Pinterest reported second-quarter earnings on Thursday in which it beat on sales but missed on earnings per share. Sales in Pinterest's second quarter grew 17% year-over-year while net income was $38.76 million, up from $8.9 million a year ago during the same period.

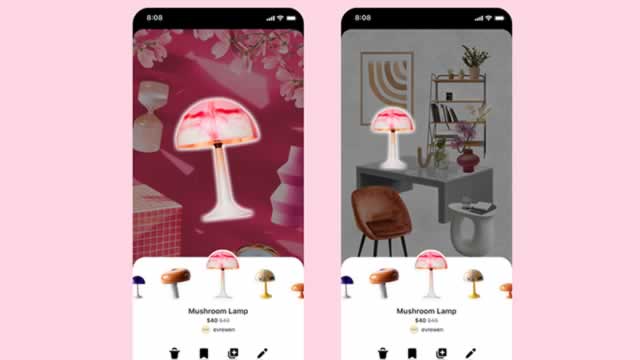

Pinterest beat analysts' estimates for second-quarter revenue on Thursday, as increased marketing spend on the platform was fueled by its artificial intelligence-powered advertising tools.