PINS Stock Recent News

PINS LATEST HEADLINES

Explore Pinterest's (PINS) international revenue trends and how these numbers impact Wall Street's forecasts and what's ahead for the stock.

Pinterest (PINS -10.17%) reported its second-quarter earnings recently, and the stock fell by about 12% the next day. Although top-line revenue is growing faster than expected, the company's profitability was a little lower than analysts had hoped for, and there are some concerns about the effect of new tariffs on ad demand.

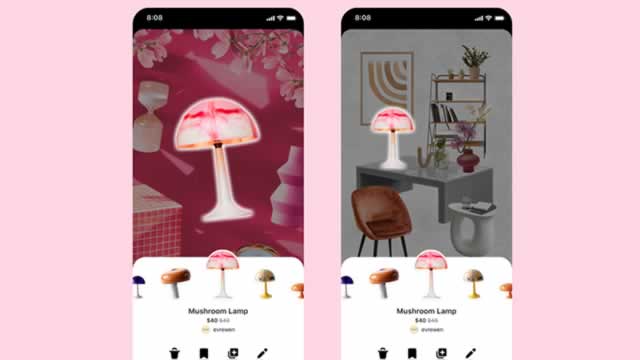

Pinterest CEO Bill Ready said Friday (Aug. 8) that it will be some time before consumers are ready to let artificial intelligence (AI) agents do their shopping for them, but that Pinterest is providing AI-powered tools that will “meet the user where they are” in the meantime.

Pinterest reported its second-quarter earnings on Thursday, August 7, and, in many ways, it was good news—though you wouldn't know it from how much its shares have dropped. Here's what to know:

A key takeaway from tech earnings was the impact of artificial intelligence on digital advertising. Meta and Alphabet both reported sales and earnings that beat Wall Street's expectations, and Reddit reported strong second-quarter sales of $500 million.

Pinterest CEO Bill Ready told investors on the company's second-quarter earnings call that the social app and inspirational bookmarking site could be considered an “AI-enabled shopping assistant.” However, he thinks that the agentic web, where AI agents shop on users' behalf, is still far in the future.

PINS posts record user growth and revenue gains in Q2, but earnings fall short of analyst expectations.

Pinterest Inc (NYSE:PINS) shares fell more than 8% after it reported second quarter earnings that fell short of Wall Street expectations, but Wedbush analysts remain bullish on the social media platform, suggesting investors buy the dip. For Q2, Pinterest report adjusted earnings per share (EPS) of $0.33, short of the expected $0.35.

Pinterest shares plunged about 15% on Friday after the image-sharing platform warned of weaker ad spending in the U.S., its biggest market, due to the removal of the "de minimis" trade loophole.

Pinterest stock price suffered a harsh reversal, crashing by over 10% in extended hours after the company published mixed financial results. PINS fell to $34.95, down by over 12% from the year-to-date high.