SNA Stock Recent News

SNA LATEST HEADLINES

Evaluate Snap-On's (SNA) reliance on international revenue to better understand the company's financial stability, growth prospects and potential stock price performance.

Snap-on (SNA 0.13%) reported its fiscal 2025 second quarter results on July 17, 2025, with revenues flat at $1.18 billion and organic sales down 0.7%. EPS of $4.72 (GAAP) was impacted by a $0.09 per share increase in pension amortization costs.

Snap-On's NYSE: SNA stock price action threw a strong signal following the Q2 earnings release and outlook update, signalling that a rapid increase in share price will follow. The signal is a 6% increase in the share price, revealing a high degree of market commitment.

Snap-on Incorporated (NYSE:SNA ) Q2 2025 Earnings Conference Call July 17, 2025 10:00 AM ET Company Participants Aldo J. Pagliari - Senior VP of Finance & CFO Nicholas T.

SNA beats Q2 estimates with strong Tools Group sales and resilient margins despite a y/y earnings decline.

The headline numbers for Snap-On (SNA) give insight into how the company performed in the quarter ended June 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

KENOSHA, Wis.--(BUSINESS WIRE)--Snap-on announces second quarter 2025 results including sales of $1,179.4 million and diluted EPS of $4.72 in the quarter.

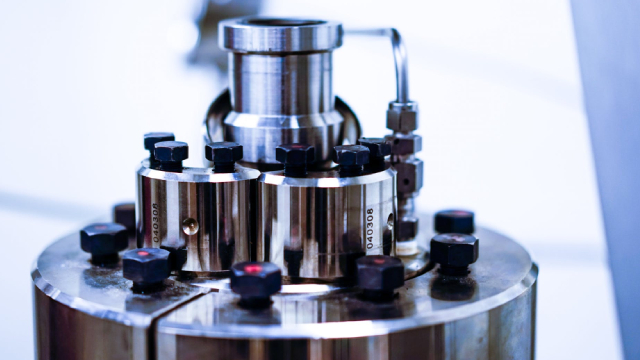

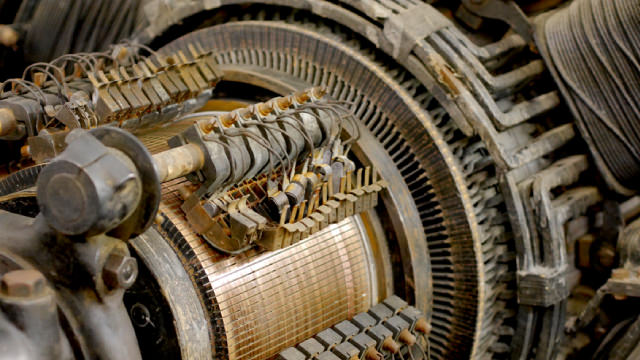

Snap-on (NYSE:SNA), a prominent American designer, manufacturer, and marketer of premium tools and equipment for the transportation sector, is set to report its earnings on Thursday, July 17, 2025. For traders focusing on events, evaluating the stock's historical performance in relation to earnings releases can offer useful insights.

Get a deeper insight into the potential performance of Snap-On (SNA) for the quarter ended June 2025 by going beyond Wall Street's top-and-bottom-line estimates and examining the estimates for some of its key metrics.

SNA grapples with macro headwinds and cost inflation amid a slowdown in its Tools Group segment.