MU Stock Recent News

MU LATEST HEADLINES

Investment bank Baird has named Micron as one of its "Best Stock Ideas" ahead of the memory-chip maker's fiscal fourth-quarter earnings report.

The Investment Committee debate the latest Calls of the Day.

Zacks.com users have recently been watching Micron (MU) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

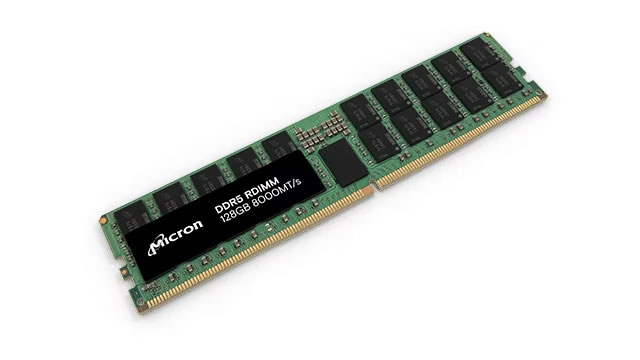

CLSA initiated coverage of Micron with an Outperform rating and $155 price target. The firm believes the company is positioned well to benefit from demand for high bandwidth memory and a "healthy" DRAM demand/supply balance. The supply of conventional DRAM will remain constrained due a focus by suppliers on high bandwidth memory, the analyst tells investors in a research note.

What has provided the biggest tailwind for the stock market over the last three years? Anyone who has paid attention can easily answer that question.

Micron Technology, Inc. remains fundamentally strong, benefiting from AI-driven demand and robust financial performance, as highlighted in my previous bullish call. Micron is currently valued as if it lacks both soaring EPS and significant AI exposure, with its forward P/E ratio for FY2026 nearly identical to that of Verizon. The company recently delivered a notable across-the-board upgrade to its FQ4 guidance, reinforcing its fundamental strength and AI-driven momentum.

Here is how Micron (MU) and Bel Fuse (BELFB) have performed compared to their sector so far this year.

Digital adoption is accelerating worldwide, from cloud platforms to artificial intelligence (AI)-driven services. Unsurprisingly, companies building digital infrastructure or offering breakthrough digital innovations are seeing demand compound rapidly.

In the most recent trading session, Micron (MU) closed at $116.47, indicating a -1.03% shift from the previous trading day.

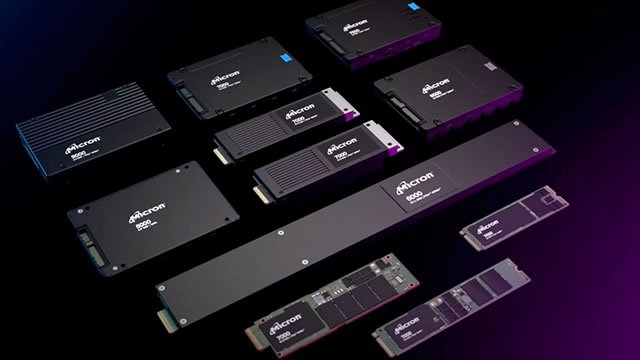

Micron Technology, Inc.'s turnaround is remarkable, driven by surging demand for DRAM and NAND in AI and data centers, resulting in strong revenue and margin growth. Management expects continued momentum, fueled by AI adoption and massive capex from big tech, positioning Micron as a leader in high-bandwidth memory. Micron's robust financial position, improving profitability, and proactive U.S. expansion mitigate macro and geopolitical risks, enhancing long-term resilience.