MU Stock Recent News

MU LATEST HEADLINES

The latest pronouncement from President Trump on tariffs for microchips had investors concerned about chipmakers on Friday. One of the victims was a sector mainstay, Micron Technologies (MU -3.50%), whose share price closed more than 3% down that day.

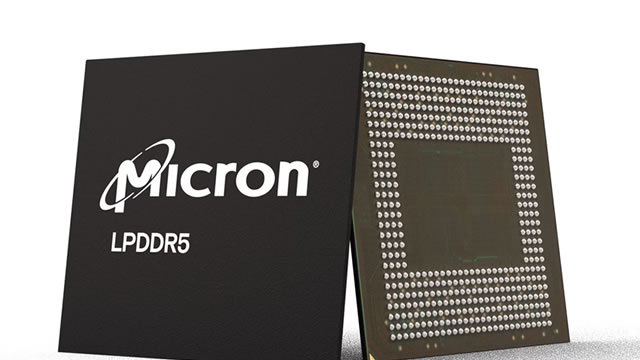

Micron Technology (MU -3.76%) is playing a central role in the adoption of artificial intelligence (AI) technology: Its memory chips are being used by top chip designers such as Nvidia and Advanced Micro Devices in their data center graphics cards.

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Micron (MU) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

OpenAI's commercial launch of ChatGPT on Nov. 30, 2022, ignited a seismic structural shift in the technology landscape. In particular, demand for enterprise productivity software and collaborative chat tools took a back seat to an intense focus on hardware -- notably, graphics processing units (GPUs) and networking equipment for data centers.

Micron is set to deliver market-beating returns due to strong execution, AI-driven demand, and an attractive valuation. AI, data centers, robotics, and automotive markets are creating sustained, secular demand for Micron's memory and storage solutions. Recent guidance raises and improving industry trends signal a cyclical bottom, with earnings estimates and fundamentals on the rise.

Micron Technologies' NASDAQ: MU stock is in rebound mode as of mid-August and will likely continue higher because its market has yet to price in the long-term impact of AI. AI is a memory-intensive technology, and its needs are expected to grow exponentially with each upcoming generation.

Chip stocks trend as profit-taking meets massive AI spending plans, led by $250B+ investments from Meta, Microsoft, and Google.

The tech sector is no stranger to market-leading gains. Over the past eight years, it's finished first or second among the S&P 500's 11 sectors five times.

Over the last few weeks, several big tech companies have reported earnings for the second calendar quarter of 2025. One of the biggest takeaways from behemoth artificial intelligence (AI) developers like Alphabet, Meta Platforms, Microsoft, and Amazon is that investment in infrastructure continues to surge.