MU Stock Recent News

MU LATEST HEADLINES

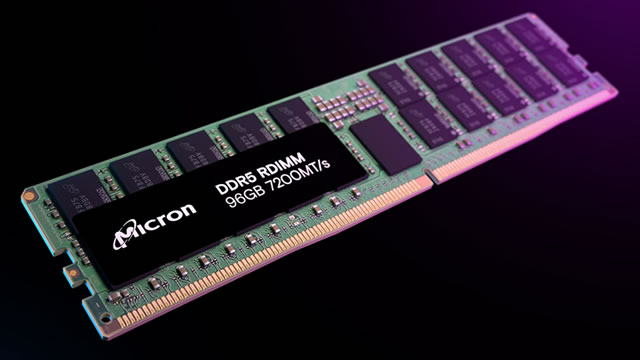

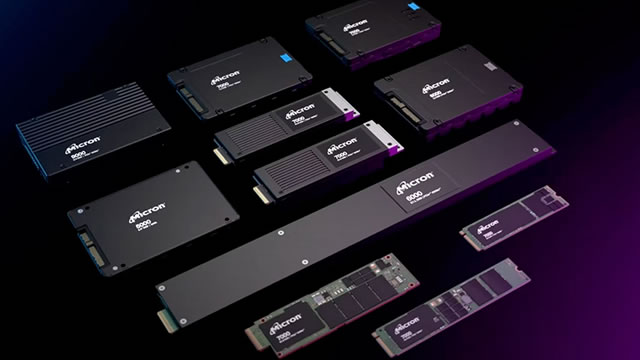

MU rides on soaring AI-driven HBM demand, with 2025 supply sold out and next-gen products fueling growth momentum.

The Zacks Focus List offers investors a way to easily find top-rated stocks and build a winning investment portfolio. Here's why you should take advantage.

Listen on the go! A daily podcast of Wall Street Breakfast will be available by 8:00 a.m.

On Wednesday, semiconductor giant Nvidia (NVDA 1.65%) will release its second-quarter earnings report.

I focus on 14 'safer' dividend stocks from Bloomberg's 50 Companies to Watch, where free cash flow yield exceeds dividend yield, signaling strong sustainability. Five 'IDEAL' stocks—China Hongqiao, ITV, Vodacom, Subsea 7, and Advanced Info—offer dividends from $1,000 invested that surpass their share price, marking them as top watchlist candidates. Analysts project average net-gains of 17.34% for the top ten dividend focus stocks by August 2026, with risk profiles varying across the group.

In the seven months since President Donald Trump's inauguration, Wall Street's major stock indexes have been taken on quite the ride.

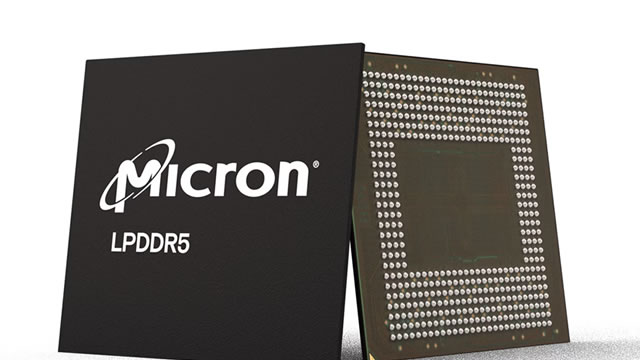

Unlike Intel (INTC), Taiwan Semiconductor Manufacturing Company (TSM) and Micron (MU) may not be required to give up stakes in exchange for their CHIPS Act grants, following some signs of pushback in early talks.

WASHINGTON, Aug 21 (Reuters) - The Trump administration is considering taking equity stakes in companies getting funds from the 2022 CHIPS Act but has no similar plans for bigger firms boosting U.S. investments, such as TSMC and Micron, a White House official told Reuters.

Administration isn't eyeing equity in semiconductor companies that are increasing U.S. investment like TSMC and Micron, but may take stakes in others.

The average of price targets set by Wall Street analysts indicates a potential upside of 30% in Micron (MU). While the effectiveness of this highly sought-after metric is questionable, the positive trend in earnings estimate revisions might translate into an upside in the stock.