MU Stock Recent News

MU LATEST HEADLINES

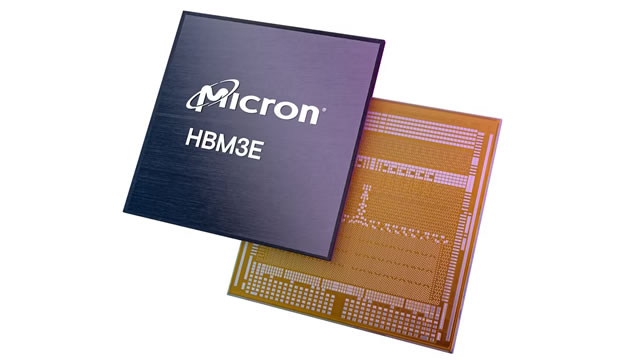

I reiterate my strong buy rating on Micron. HBM is still the main pillar of my case, as I believe it is the single biggest growth engine. HBM supply sold out for 2025. HBM revenue up ~50% q/q and shipping includes the MI355X, which is ramping. HBM4 sampling now, with a ramp next year. Valuation supports my strong buy on MU stock, in my view: ~16.5x next year's EPS vs ~29.8x industry median. P/CF down sharply from 2024, suggesting undervaluation.

Computer memory specialist Micron Technology (MU -5.19%) stock tumbled 6.2% through 10:30 a.m. ET Wednesday, and for one simple reason: As you've probably heard, Bloomberg reports that President Trump is planning to take an equity stake in Intel (INTC -6.52%).

MU trades near its 52-week high and rallies 45% YTD as AI demand, HBM growth and a discounted valuation support a buy strategy.

MU, FUTU, RL, MSBHF and MITSY have been added to the Zacks Rank #1 (Strong Buy) List on August 20, 2025.

Intel looks to be set to get the U.S. government as a shareholder. The Trump administration could pursue equity stakes in other companies including Taiwan Semiconductor Manufacturing

The latest trading day saw Micron (MU) settling at $122, representing a -1.26% change from its previous close.

Most investors are rightfully wary of trading or buying a stock during earnings season, since the implied volatility around the announcement dates can throw off even the shrewdest in the marketplace. However, knowing what to look for helps in a situation like this, and that is where an opportunity for continued rallies has just shown up inside the technology sector of the United States.

Micron Technology stock (NASDQ:MU) increased by about 6% in the last month and is up nearly 40% year-to-date. The company has recently raised its Q4 FY'25 forecast, expecting revenue of $11.2 billion at the midpoint, an increase from its previous estimate of $10.7 billion, with adjusted earnings projected to be $2.85 at the midpoint, up from $2.50.

S&P 500 giants Netflix and Amazon topped early entries last week, with three other stocks near buy points.

Micron posted record Q3 FY2025 revenue of $9.30 billion, up from $8.05 billion in Q2 and driven by all‑time‑high DRAM sales. HBM revenue grew nearly 50 percent sequentially, validating the trade ratio squeeze thesis and strong AI‑driven demand from data centers. Non‑GAAP gross margin expanded to 39.0 percent and operating cash flow reached $4.61 billion, reflecting improved pricing power and product mix.